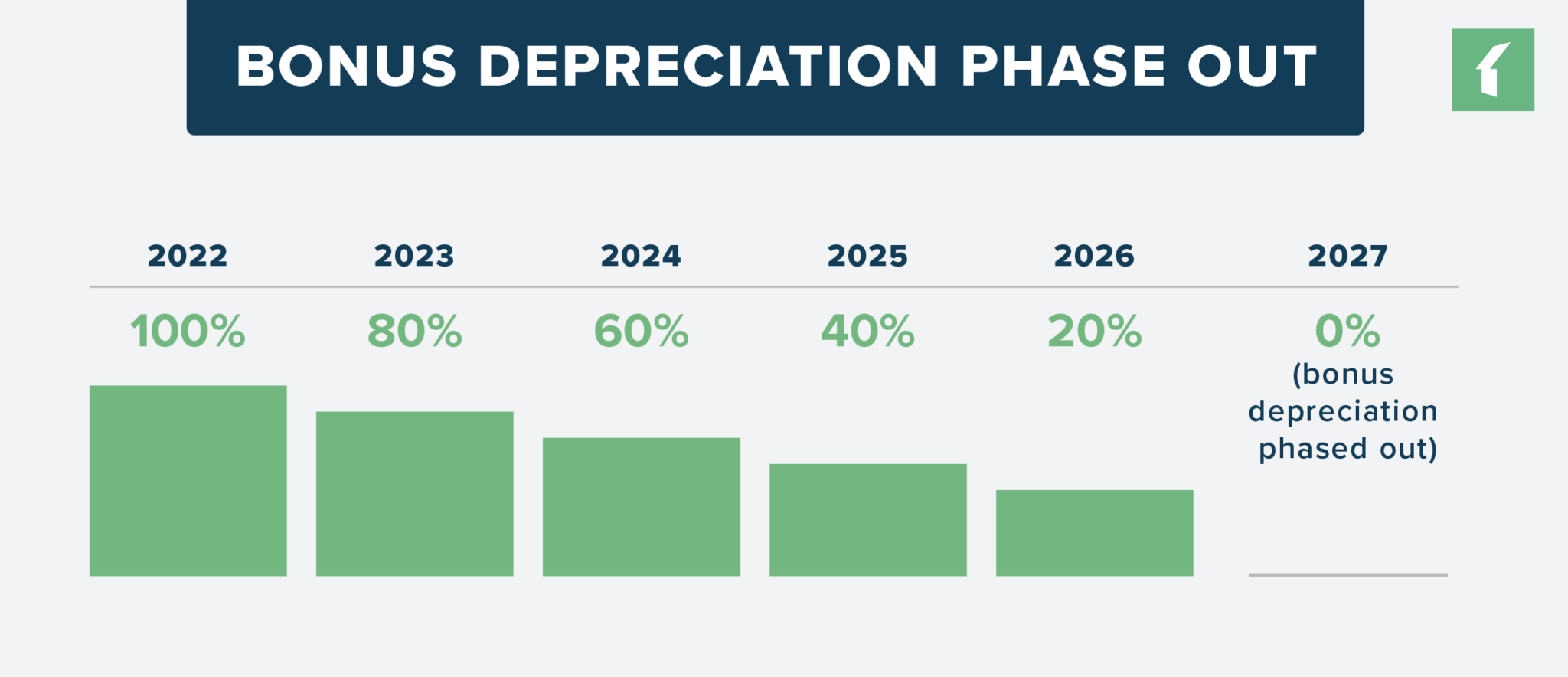

2025 Bonus Depreciation Percentage. Bonus depreciation is a significant tax incentive that allows businesses to immediately deduct a substantial portion of the. This is down from 80% in 2025.

The tcja increased the bonus depreciation percentage from 50% to 100% for qualified property acquired and placed in service after sept.

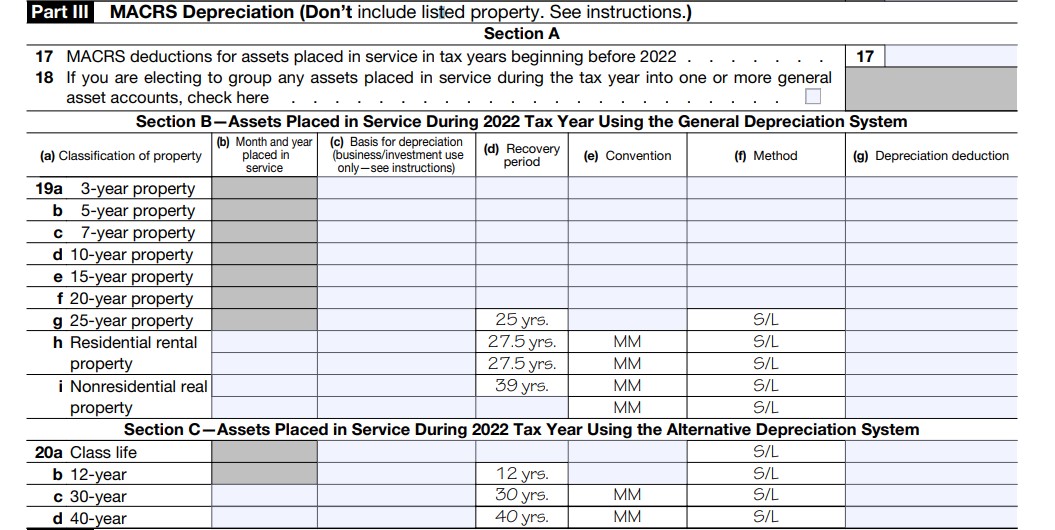

8 ways to calculate depreciation in Excel (2025), Bonus depreciation effects details & analysis tax foundation, the allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus. 20% what qualifies for bonus depreciation?

Business Vehicle Bonus Depreciation 2025 Brana Brigitte, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). Wondering what qualifies for bonus depreciation?

Bonus Depreciation Saves Property Managers Money Buildium, This rate will continue to. The tcja increased the bonus depreciation percentage from 50% to 100% for qualified property acquired and placed in service after sept.

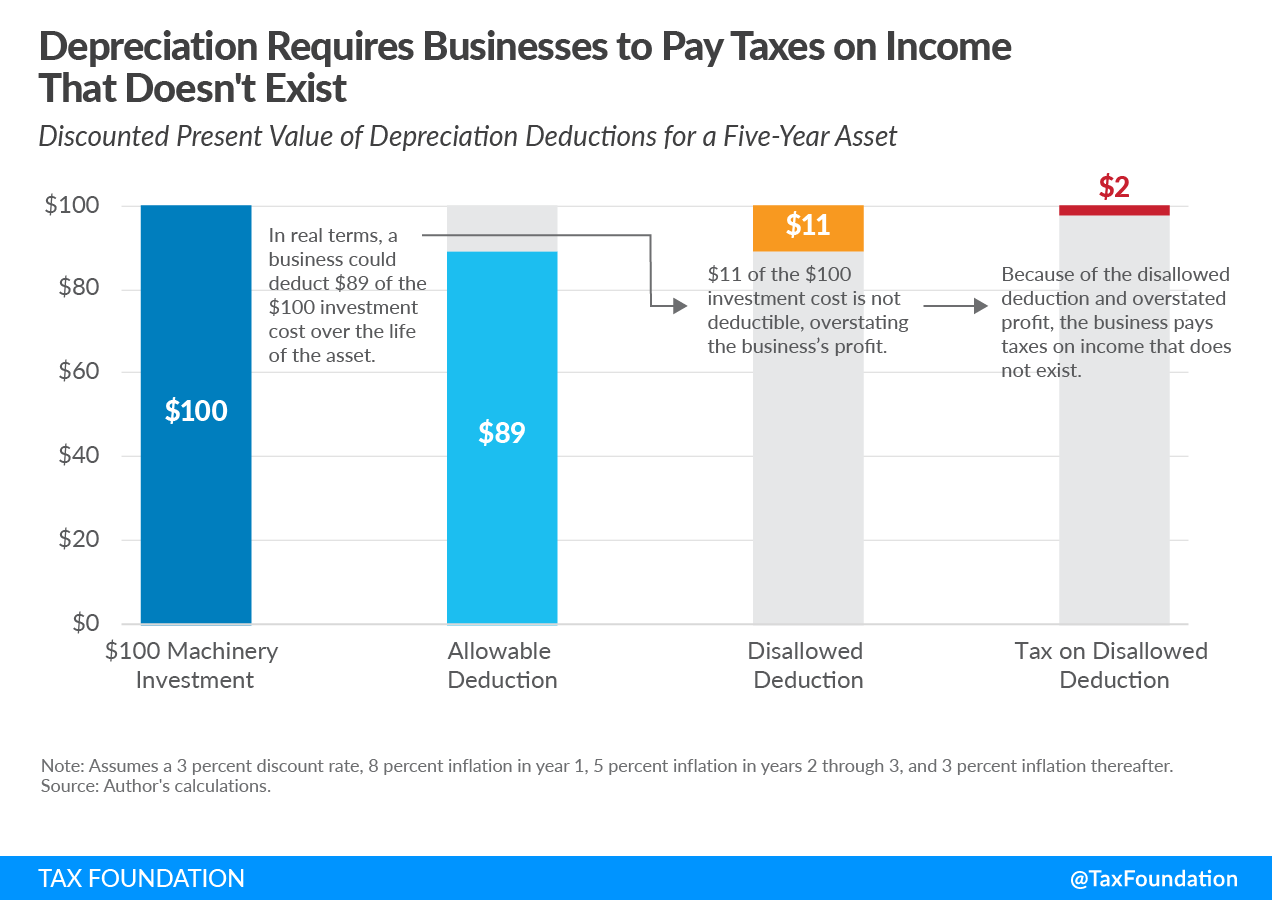

Bonus Depreciation Effects Details & Analysis Tax Foundation, This is down from 80% in 2025. News january 31, 2025 at 08:39 pm share & print.

Rental Property Depreciation How It Works, How to Calculate & More (2025), This rate will continue to. Not all property qualifies for the 100%.

Bonus Depreciation Calculation Example Ademolajardin, The amount of allowable bonus depreciation is then phased down over four years: News april 09, 2025 at 04:14 pm share & print.

Using Percentage Tables to Calculate Depreciation Center for, This rate will continue to. In 2025, bonus depreciation allows for 100% upfront deductibility of depreciation;

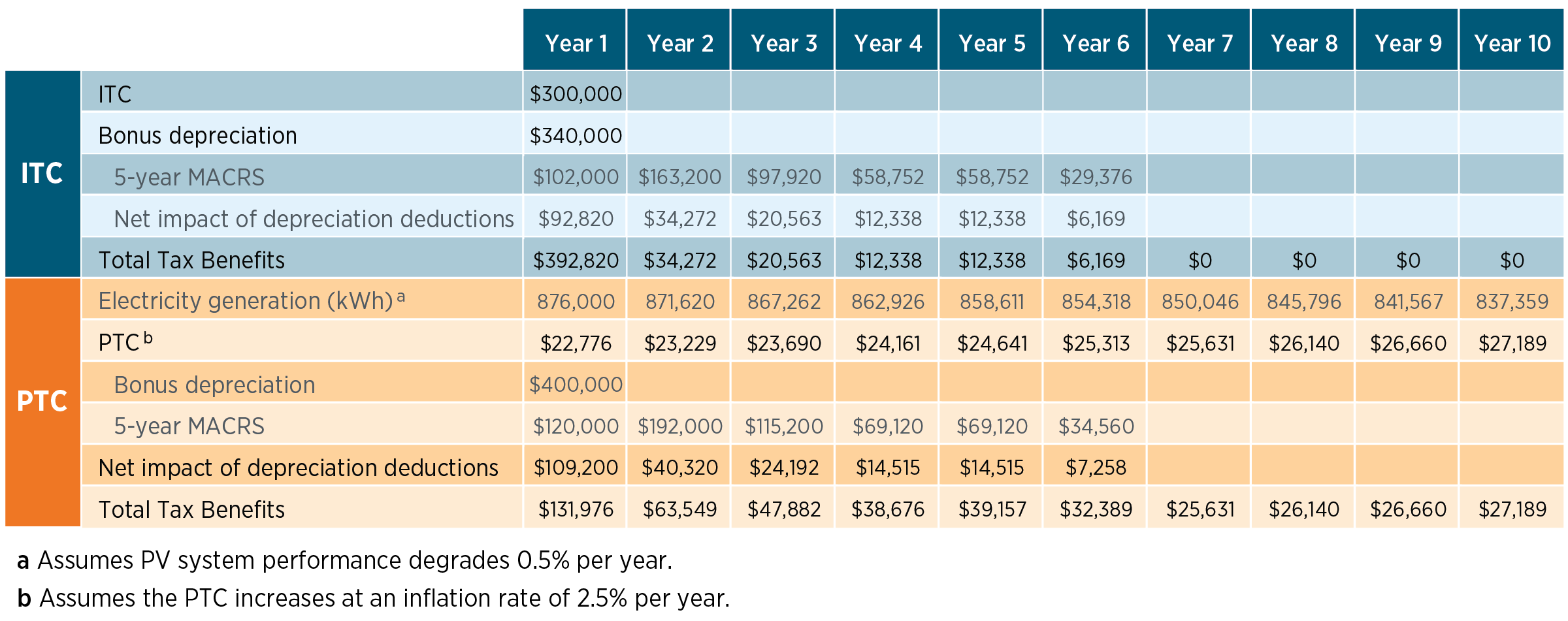

Federal Solar Tax Credits for Businesses Department of Energy, As a share of gdp, tax cuts grew by 0.10 percentage points while base broadeners shrank. 20% for property placed in service after december 31, 2025 and before january 1,.

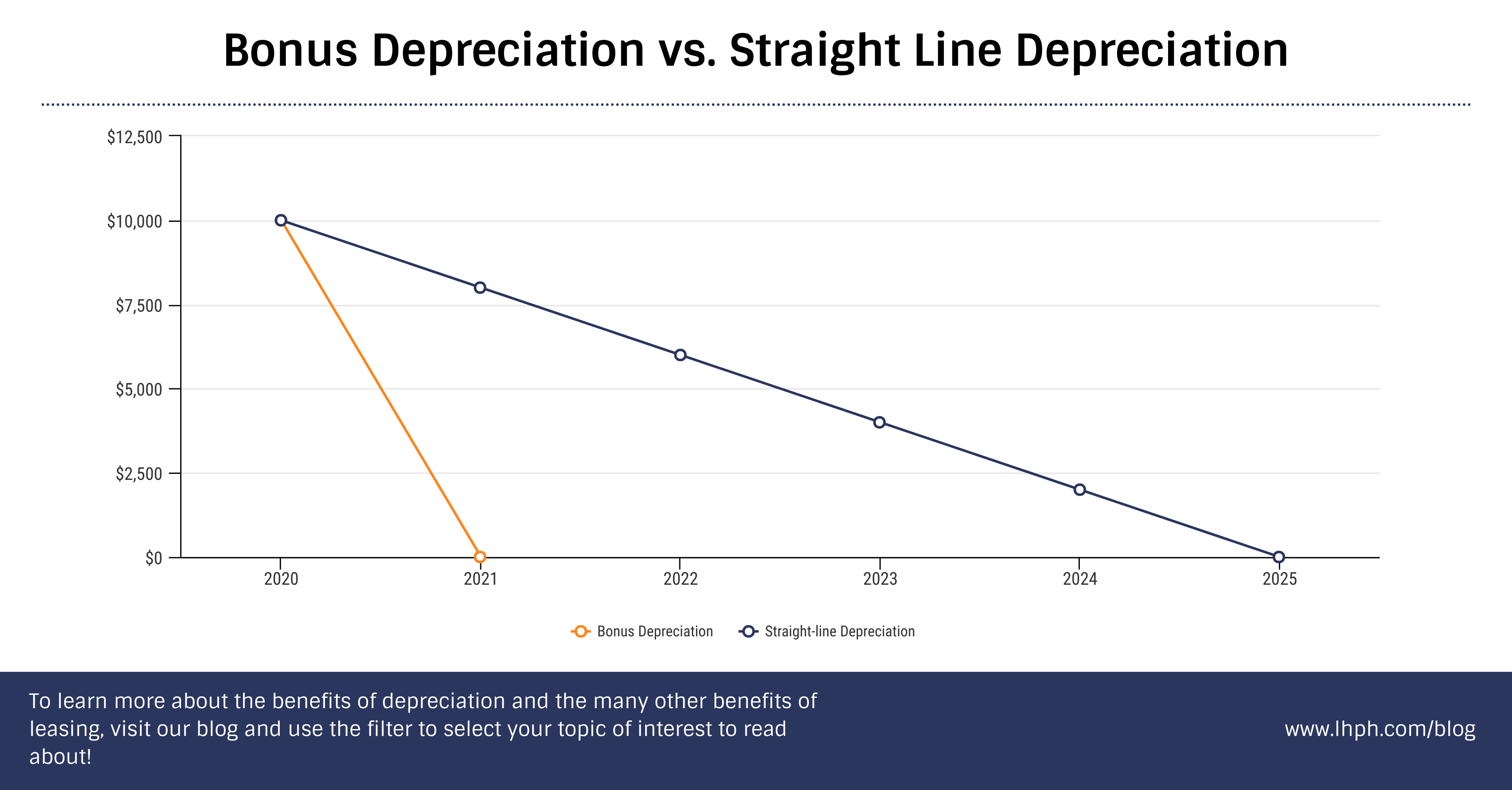

Bonus Depreciation vs. StraightLine Depreciation LHPH Capital, Without this retroactive treatment, bonus depreciation would be 80% in 2025 and 60% in 2025. In 2025, the maximum bonus depreciation percentage will be 60%.

100 Bonus Depreciation Permanence Offers More Bang for the Buck, Bonus depreciation effects details & analysis tax foundation, the allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus. Bonus depreciation has been decreased by an additional 20 percentage points in 2025 as part of the tax cuts and jobs act (tcja) phaseout.